The new, Taliban-appointed head of Afghanistan’s central bank has sought to reassure banks the group wants a fully-functioning financial system, but has so far provided little detail on how it will supply funds to sustain it, said four bankers familiar with the matter.

The acting central bank governor, Haji Mohammad Idris, met members of the Afghanistan Banks Association and other bankers this week, and told them that the Taliban viewed the banking sector as imperative, said two bankers who attended the meeting.

Uncertainty over the Taliban’s relationship with the international community is raising doubts over its ability to revive an economy shattered by 40 years of war and reliant on aid and foreign currency reserves, the latter largely out of reach in the United States.

The militant group which now controls the country was working to find solutions for liquidity and rising inflation, the bankers quoted Idris as saying. “They were very charming and asked banks what their concerns were,” said one of the bankers who requested anonymity.

Under the Taliban’s previous rule between 1996 and 2001, Afghanistan had little functioning banking sector and although a handful of commercial banks retained licences none were operational and few loans were made.

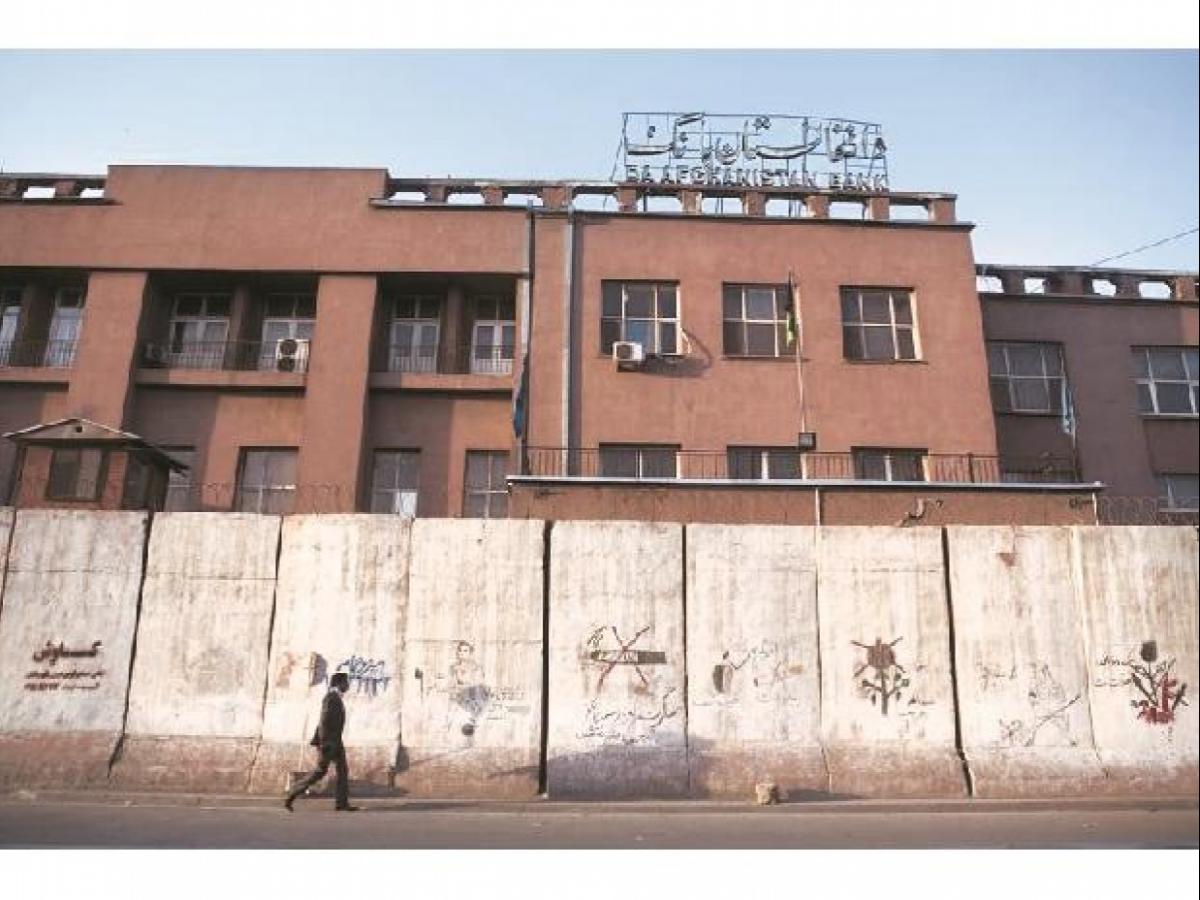

Idris, a Taliban loyalist who has no formal financial training or higher education, was appointed to head the central bank last week. He and his team did not tell the bankers how much cash Da Afghanistan Bank (DAB), the central bank, had access to, nor did they give any indication about how the Taliban would approach its relationship with the United States, one of the bankers said. The central bank provided liquidity to banks in recent days, said two of the bankers, with one adding that DAB paid a portion of the amount each bank requested.

Now you can get latest stories from Hydnow everyday. Click the link to subscribe. Click to follow Hydnow Facebook page and Twitter and on Instagram